As a budgeting nerd, there is no personal finance tool closer to my heart than the zero-based budget. And I’m determined to get you to love it by sharing these zero-based budget templates.

If you haven’t fallen in love with the zero-based budget yet, be prepared to learn how implementing one in your financial life can rock your world.

Table of Contents

- What Is a Zero-Based Budget?

- How to Set Up a Zero-Based Budget

- 1. Calculate Your Monthly Income

- 2. Determine Your Monthly Expenses

- 3. Make a Plan for Leftover Money

- 4. Track Your Expenses Regularly

- Top 5 Zero-Based Budget Templates

- Best Comprehensive Budgeting Template

- Best Printable Zero-Based Budget Template

- Best Versatile Zero-Based Budget Template

- Best Budget Template for 50/30/20 Budgeters

- Best “Anytime, Anywhere” Budget Template

- Top 5 Budgeting Apps

- Final Thoughts

What Is a Zero-Based Budget?

A zero-based budget is a straightforward concept that not enough people understand.

The concept is simple: Make sure every dollar you bring in has a designated purpose. Execution of this simple concept, however, is another animal altogether.

Living successfully on a zero-based budget takes two essential ingredients: knowledge and planning. Keep reading to learn how you can set up a zero-based budget that can change your finances for the better.

How to Set Up a Zero-Based Budget

Setting up a successful zero-based budget requires utilizing four different steps. And you’ll need all four steps if you want the concept to be fruitful in your life.

1. Calculate Your Monthly Income

You’ll want to start by calculating your monthly income. If you live on a variable income, you’ll need to do this step every month.

You’ve got two options for calculating your income: You can use your gross income and include taxes and deductions in your budget. Or, start with your net income and don’t include taxes and deductions in your budget. Include all income sources, including monthly, quarterly, and annual bonuses, commissions, etc.

“Extra” money needs to have a job, too, even if that job includes a bit of reckless spending (which is perfectly acceptable).

2. Determine Your Monthly Expenses

Next, you’ll want to determine your monthly expenses. You should do this at the beginning of every month because every month sees different expenses.

For instance, you might have birthday gifts to buy one month and not the next. Or, you might have semi-annual insurance premiums to pay in any given month.

*Note: For non-regular expenses, it can be helpful to set aside an amount in your budget for those expenses, i.e., car repairs. This is where the envelope budgeting system might come in handy.

3. Make a Plan for Leftover Money

Once you’ve determined your income and expenses, it’s time to make a plan for the leftover money to force your income after expenses to equal zero, hence the name “zero-based” budget.

Hint: If you don’t have any leftover money or are in the red (more expenses than income), now is the time to find places to cut costs.

Ditch the cable or satellite bill, cut down on restaurant meals, or find other non-necessity items in your budget that you can eliminate–at least temporarily.

If you still can’t find extra money in your budget, it may be time to pick up a side hustle and get some extra income.

As far as what to do with your leftover money, that depends greatly on your financial goals. However, here are some options for you:

- Beef up your emergency fund

- Put extra money toward debt

- Contribute more to retirement funds

- Add to a non-retirement investment account

- Save money for a vacation or other large expense

- Save money for your child’s college education

The possibilities are endless. Use your financial goals as a guide, and then divide up the extra income you have each month, putting some money toward each goal as you see fit.

And finally, don’t forget this next important step.

4. Track Your Expenses Regularly

I always recommend tracking your expenses – all of them – for at least six months. It’s an important step because tracking will help you understand your spending in each budget category.

You might be surprised at how much you spend on fluid categories such as groceries, gasoline, entertainment spending, etc. Tracking your expenses for several months will help you understand where your budget numbers might be off and where you may need to adjust your spending.

Now that you have an idea of assembling your zero-based budget let’s look at some templates you can use to create one.

Top 5 Zero-Based Budget Templates

Here are five excellent and free, zero-based budget templates to help you manage your money. I’ve included fillable spreadsheets and PDF printables for those who prefer to budget the old-fashioned way. 😉

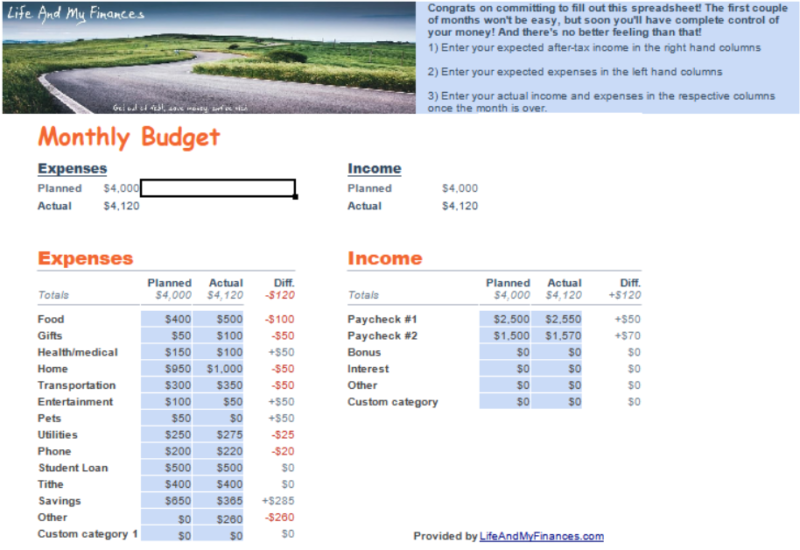

Best Comprehensive Budgeting Template

Cost: Free

Over at Life and My Finances, Derek has a comprehensive set of financial tools he offers free of charge.

The online, fillable budget spreadsheet is available for Excel users.

While visiting Derek’s site, take advantage of the other spreadsheets such as the Debt Snowball spreadsheet and the College Investment Calculator.

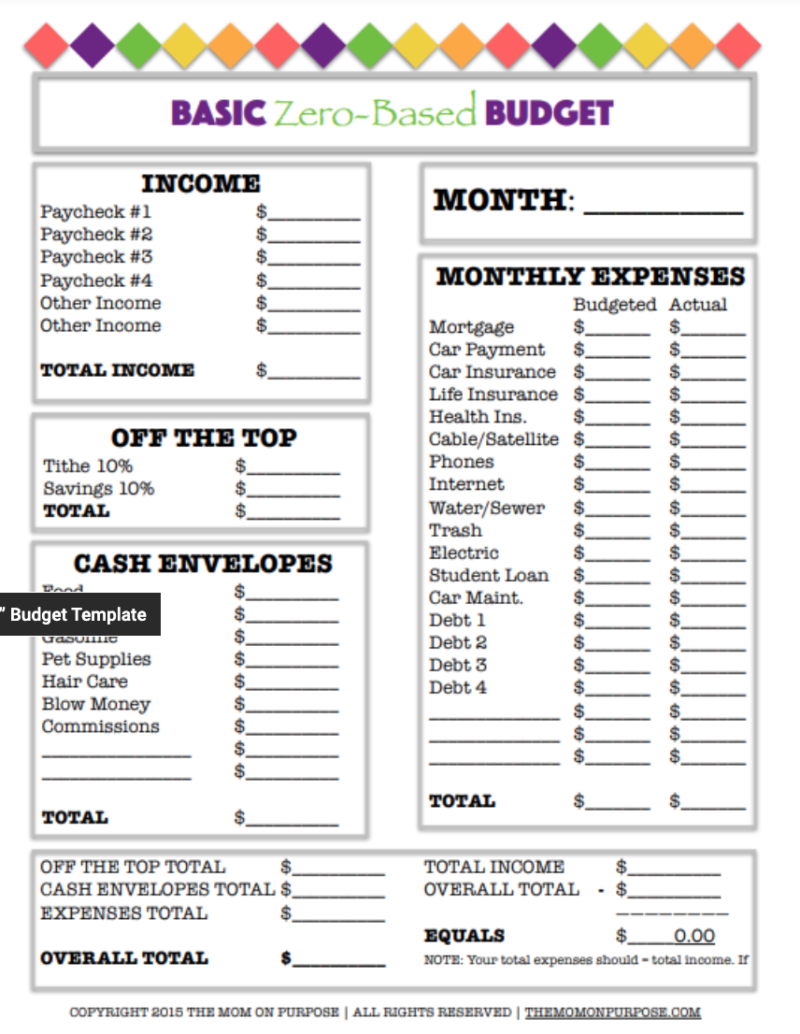

Best Printable Zero-Based Budget Template

Cost: Free

The Simply Organized Home zero-based budget template has a free budget template that you can print in color or black-and-white.

The template requires that your bottom line is $0, and it also has spaces to put line items for envelope budgeting categories such as food, pet care, and blow money.

As an old-fashioned paper budgeting fan, I love the printable budgeting templates!

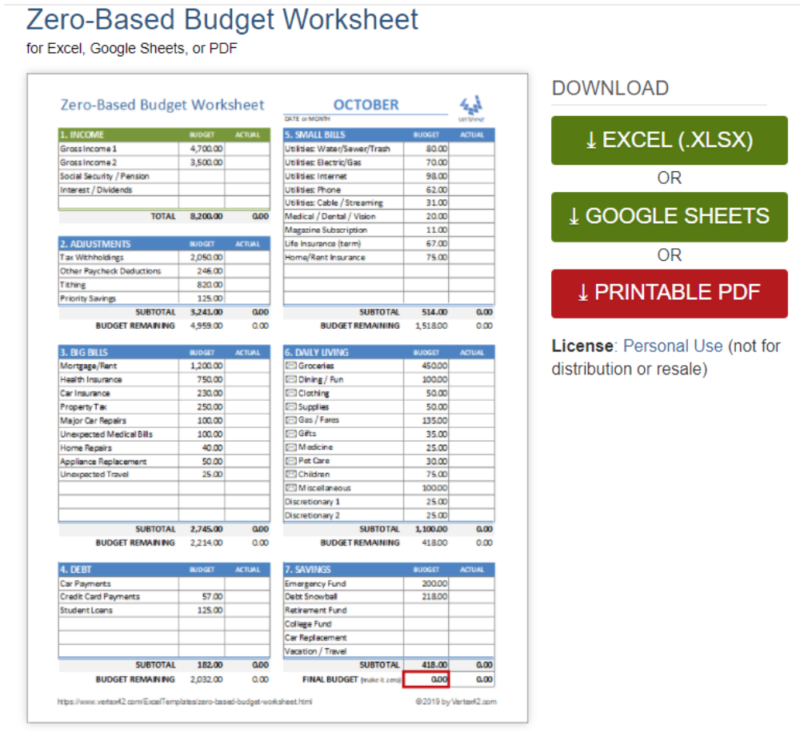

Best Versatile Zero-Based Budget Template

Cost: Free

I like the Vertex42 zero-based budget template because it gives you three user options: Excel download, Google Sheets download, or free printable PDF download.

This template uses your gross income and has space for paycheck deductions, but you could always modify it to use your net income.

And it includes additional spaces for expenses categories outside of the norm.

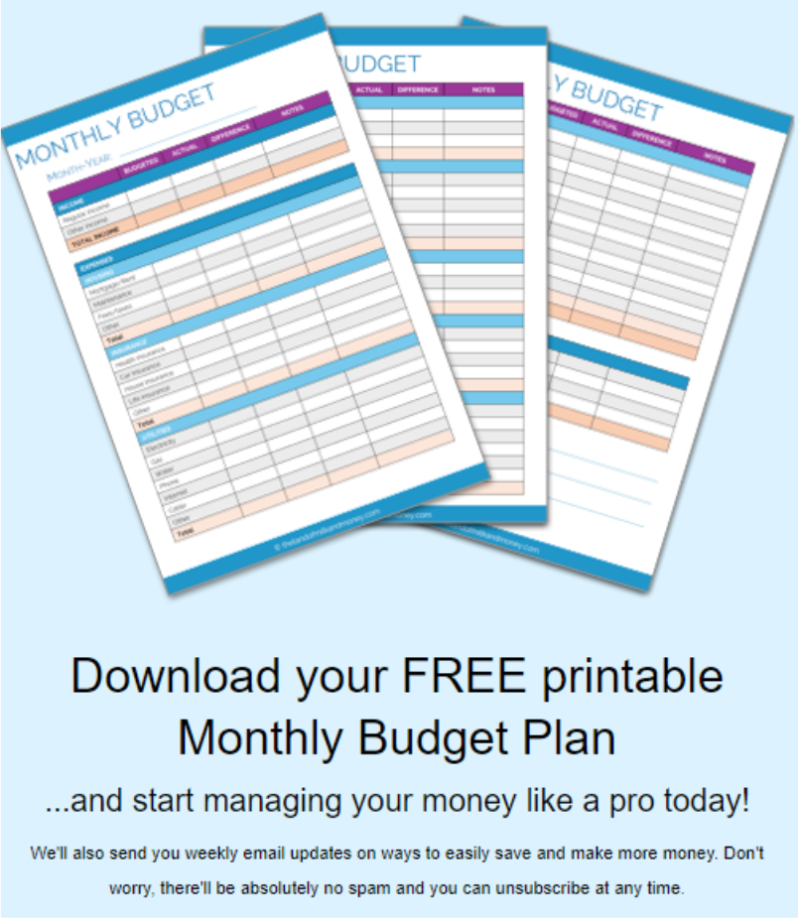

Best Budget Template for 50/30/20 Budgeters

Cost: Free

This 50/30/20 budget template is ideal for people who aren’t living paycheck-to-paycheck and have a desire to reach their financial goals faster.

You’ll have to subscribe to The Land of Milk and Money’s blog to access the template. But I’m confident you’ll find the information on the blog more than worthwhile.

Best “Anytime, Anywhere” Budget Template

Cost: Free

Google Sheets has a free budget template for anyone with a Google account.

The summary at the top of the page will show you your starting and ending account balance and how much you saved during the money.

Now that you’ve got an idea of where to find some awesome zero-based budgeting templates, let’s talk about the top budgeting apps you can use to create a zero-based budget.

Top 5 Budgeting Apps

Are you looking to make budgeting even easier? Consider these top budgeting apps to keep your zero-based budget at your fingertips.

YNAB

Cost: $8.25 to $14.99 per month

The YNAB (You Need a Budget) app is a popular zero-based budget. It works on the premise of four simple steps:

- Give every dollar a job

- Embrace your true expenses (i.e., no guilt)

- Roll with the punches

- Age your money

YNAB is an intelligent program that is relatively easy to set up and follow. Automatic import of transactions is available, and there’s a 34-day free trial to get you started. For more information, check out our full YNAB review.

Personal Capital

Cost: Free

Personal Capital is well-known in the personal finance world for being a great app to help you gather all of your financial accounts in one place.

At a glance, you’ll be able to see your assets, liabilities, and your net worth. Personal Capital’s budgeting tools are adequate, but they may not be sufficient for serious budgeting junkies.

However, if growing your investments is a prominent part of your budgeting plan, you might prefer Personal Capital’s focus on investing. Read our full review of Personal Capital for more details.

Mint

🚨 Intuit has announced that Mint.com will be shutting down in early 2023. They’ve pointed users to consider Credit Karma instead but I don’t think that’s the best solution – here are our favorite Mint alternatives.

Cost: Free

The Mint budgeting app is the app that most closely resembles Personal Capital. Both apps are free, and both will help you budget and track your financial accounts. However, the main difference is that Mint has a much stronger budgeting program than Personal Capital.

Since Mint’s focus is budgeting, you can expect robust budgeting tools and intuitive expense categories. Find out more in our full Mint review.

EveryDollar Budgeting App

Cost: $0 to $20 per month

EveryDollar created its budgeting app with the zero-based budget in mind. You’ve got two plans to choose from – Free and Ramsey+. The free EveryDollar app lets you customize your budget, create savings funds and track your debt payments.

Ramsey+ syncs with your bank account to automatically import transactions and create custom budget reports. In addition, you get access to all of Dave Ramsey’s learning content and money management tools.

Note that you’ll get discounts on the price of Ramsey+ when you pay semi-annually or annually. Read our full EveryDollar review here.

Tiller Money

Cost: $79 per year

Tiller is a budgeting app that combines the power of budgeting with free budgeting spreadsheets. The prebuilt spreadsheets can help you create a budget and track your net worth.

You can use Tiller to import your financial summaries into Google Sheets or Excel automatically. And unlike some of the other apps listed here, Tiller won’t ever show you ads. Find out more in our Tiller Money review.

Final Thoughts

With a zero-based budget, every dollar has a job. It’s a wonderful way to ensure your money isn’t wasted on expenditures contrary to your wishes. I highly recommend that you check out the templates I covered in this article and try out the one that seems the best fit.